With roughly 92% of all vanadium used in steel production,1 the second largest market for vanadium is that of catalysts and chemical applications (up to 5% of world consumption).2

In contrast to the singular nature of the steel market, this secondary 'market' represents a wide range of diverse applications. The largest among these are catalyst applications used by such industry giants as BASF and Du Pont. Smaller markets include specialized chemical applications across such fields as medical, glass, pigments, and others.

Vanadium demand from catalyst and chemical applications is projected to grow in the short- and mid-term. In particular, greater demand is expected in connection with the production of industry-vital sulfuric acid, and in the reduction of emissions from vehicles3 as well as coal-fired power plants in developing economies such as China and India.2

Demand, Supply and R&D

The largest concentration of demand for vanadium in catalysts and chemical applications originates in the U.S. and Japan. Together, the two nations account for roughly 25% of world consumption in this sector.

Meanwhile, international R&D efforts are being made to build on the efficiency and cost-effectiveness of vanadium catalysts. While the significance of such research varies by industry sector, in January 2011 the U.S. Department of Energy (DOE) explained its particular interest in advancing the field of vanadium catalysts:

"Technologies to turn intermittent power sources into use-any-time sources of energy require fuel cells that use yet-to-be-invented catalysts. In addition, the chemical and petroleum industries crave more efficient catalysts for their reactions." 5

Top Vanadium Consumers

While the list of catalyst and chemical applications relying on vanadium is long and varied, the two largest consumers by volume are catalysts for sulfuric acid production, and catalysts for synthetic rubber production.

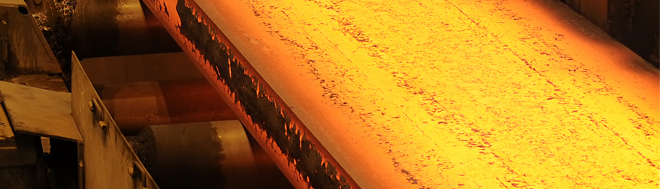

Sulfuric acid is produced to fill a wide range of industry needs, from fertilizer manufacturing to lead-acid batteries for vehicles, oil refining, wastewater processing, and others.

The production of sulfuric acid also benefits the environment through the use of the Contact Process, which is the basis of nearly all sulfuric acid plants worldwide. The process involves bringing the sulfur-containing waste gases from sources such as coal-fired power plants into contact with vanadium catalysts.

The benefits are twofold: meeting pollution control standards while producing valuable sulfuric acid as an end product.2

Another factor involved in the increasing significance of vanadium catalysts involves sulfuric acid's central role as the main material needed to refine ores containing what are known as 'rare earths' or 'rare earth metals'.6

Rare earths are crucial to new clean technologies, from compact fluorescent light bulbs to electric vehicles, giant wind turbines and more.7 At the same time, China is currently producing – and clamping down on their export of – 92% of the world's light rare earths and 99% of the world's heavy rare earths.

In turn, the rare earths market has experienced increased attention and demand,6 both of which will positively impact the related vanadium catalyst market.

Catalytic Converters & Other Applications

Vanadium-based catalysts have been used successfully to meet Europe's Euro IV and V emissions standards for vehicles. The selective catalytic reduction (SCR) catalysts have been used in both original equipment manufacturer (OEM) and retrofit applications.3

Other catalyst and chemical applications using vanadium include:

- Denitrification of industry waste streams

- Removing carbon dioxide in ammonia plants

- Treatment of Type 2 diabetes

- Production of fade-resistant dyes for textiles

- Improving the light quality of TV and computer screens

- Producing brilliant colors in ceramics and enamels

- Protecting optical instrument operators from UV rays2

1. Vanadium Market Fundamentals And Implications. Terry Perles/TTP Squared, Inc., Nov. 16, 2010

2. Roskill's Vanadium: Global Industry Markets and Outlook 2010 report

3. Global Emissions Management - Volume 2, Issue 12 Spring 2010 (Johnson Matthey)

4. Johnson Matthey website, Feb. 7, 2011

5. Pacific Northwest National Laboratory, Jan. 2011

6. New York Times website, Jan. 20, 2011

7. New York Times website, Dec. 15, 2010